The first sequencing of DNA in space was achieved using the MinION device developed by Oxford Nanopore, through patient capital. Astronaut Kate Rubins is pictured with results. Credit: NASA

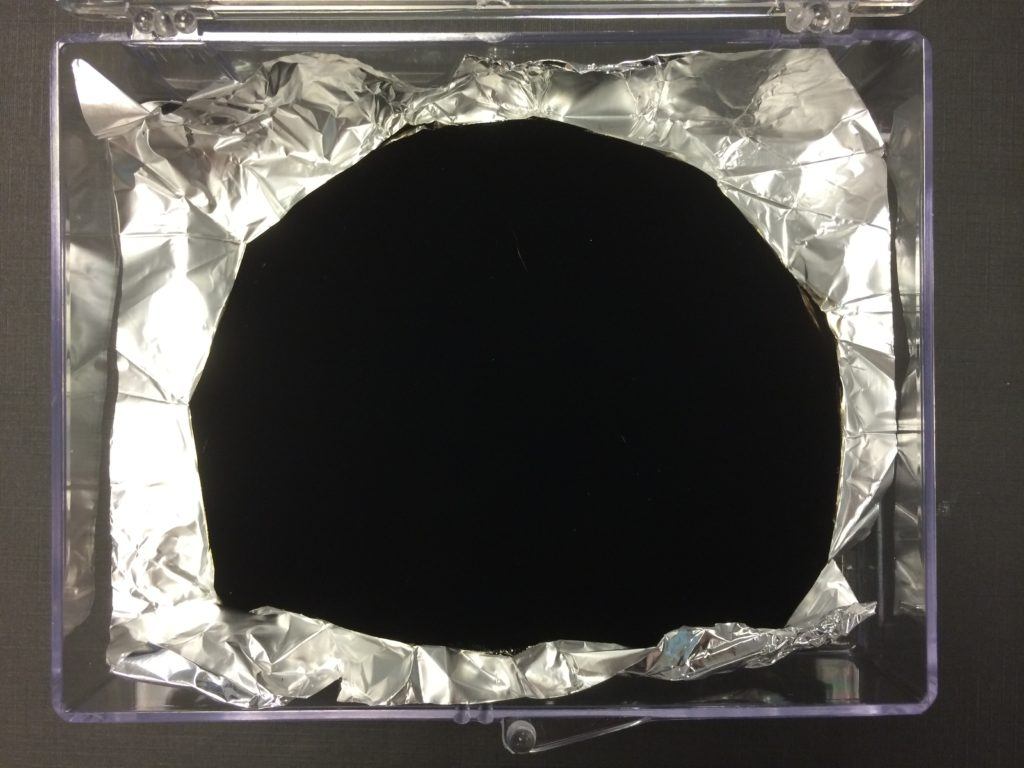

A visitor to IP Group’s smart offices near Cannon Street is greeted by a wall of curiosities. His eye will likely be drawn first to an object of quite startling blackness. When he looks more closely it will seem as if the object is playing tricks on the eye. This is Vantablack, which is said to be the darkest man-made substance in existence, absorbing 99.96 per cent of the light that hits its surface and making 3D objects appear 2D. It was developed by Surrey NanoSystems three years ago. In 2018, the British architect Asif Khan will unveil a building made of the substance at the Winter Olympics in South Korea. It will, he says, ‘be like you’re looking into the depths of space itself.’1

Then there is what from a distance looks like a harmonica. This is a MinION, a bite-sized DNA tester developed by Oxford Nanopore, which can read DNA codes in minutes and costs a revolutionary $1,000. It has been used to track the ebola virus across West Africa, and to research zika in South America. The company believes that the device will soon be used by people in their own homes and transform the way we monitor our health.

There is, oddly, a washing machine made of Lego. This represents the environmentally friendly work of Professor Stephen Burkinshaw of the University of Leeds. He was investigating how to help dyes stay on fabrics for longer and ended up solving the opposite problem. He found that polymer beads could be used to remove stains from clothes with small volumes of water. He called his company Xeros, which is the Greek word for dry.

All these are the consequence of good ideas meeting good capitalism. It is unlikely any of the companies would be in their current successful position were it not for the involvement of IP Group. It invests in early-stage innovations, mainly emerging from universities, with the aim of building them from a boffin’s Eureka! moment into a successful and, sometimes, world-changing business. As well as cash, it provides advice and practical help. With Xeros, IP drew up an initial business plan and provided interim management, including the CFO. It assisted on strategy and helped find new investors, a CEO and chairman.

IP is one of the UK’s leading players in the ‘patient capital’ sphere, where investors forego immediate returns in favour of more substantial earnings further down the line. It allows small companies to make decisions based on long-term strategy, scale up over time, and harnesses founders, staff and investors to the same ends. It is a sector that is not only good for professors with smart ideas but little business sense, but also for the badly tarnished reputation of capitalism itself. IP and companies like it are in for the long term – for example, IP has been involved with Oxford Nanopore for 12 years and has never taken a penny out. Its reward is a stake now worth something like a quarter of a billion pounds. Jacqueline Novogratz of the non-profit global venture fund Acumen describes patient capital as taking “the best of the markets as well as philanthropy and aid. Patient capital is money invested in entrepreneurs building companies and organisations that solve tough problems like healthcare, water, housing, alternative energy”.

Philip Hammond is well aware of the sector’s importance to the shape of the British economy and its future competitiveness. In his Budget next week the Chancellor is expected to publish the results of the Patient Capital Review, which he set up at the start of the year, chaired by Damon Buffini, former head of the private equity company Permira. The Review has examined the state-backed venture capital schemes known as the Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS), which give tax relief of between 30 and 50 per cent to those who invest in small, unlisted (and therefore riskier) companies. The Government felt some investors were choosing the least risky option and in effect using the schemes to cut their tax bills. The Budget seems likely to attempt to close off some of those loopholes.

Main Edition

Main Edition US

US FR

FR

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe