Warning: This is not an investment tip — it’s much more important than that. It’s about something really big, and really weird, that happened to capitalism roughly thirty years ago.

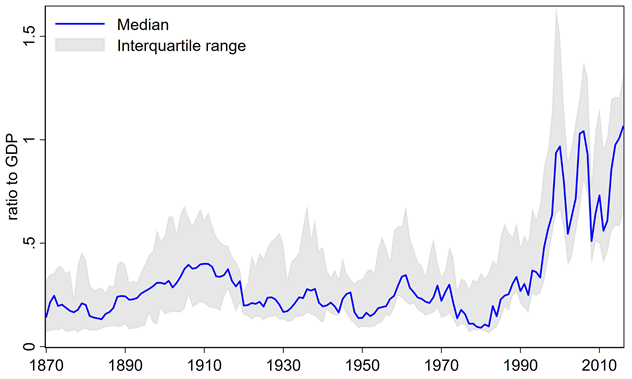

You can see it in the following chart. It’s from a VoxEU article by Dmitry Kuvshinov and Kaspar Zimmermann, and it condenses 150 years of stock market data from 17 countries. Specifically, it shows stock market capitalisation (i.e. the combined value of publicly traded shares) relative to GDP:

As you can see, the graph divides into two time periods. In the first 120 years (i.e. 1870-1990) the size of the stock market never exceeds half the size of the economy — and is usually well below that level. However, in the last 30 years, stock market capitalisation has surged — sometimes hitting 100% of GDP or more.

Of course, share prices go up and down, and I should stress that the graph shows averaged values to help cut through the noise. But that’s all more reason to be intrigued by the overall pattern. What happened to capitalism circa 1990 to make such a big difference?

Was it that publicly traded equity became a much important way for business to raise capital? Did ‘Big Bang’ stock market deregulation encourage more companies to issue more shares, thus growing the size of the overall market? If it did, that would be fine — equity finance has many advantages over debt.

But Kuvshinov and Zimmerman crunch the numbers and find that, no, this does not explain what happened. Rather, the remarkable growth of stock markets is due to share prices going up. Despite the crashes of the last three decades, investors keep piling back into stocks.

Main Edition

Main Edition US

US FR

FR

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeIt’s not a very good article, is it?

Well, as someone who has to invest in the stock markets as there is nowhere else to put my savings here are a few reasons I do:

* there’s nowhere else as interest rates have been so low since 2008

* until the pandemic, as stated in the article (at least I think that’s what you are saying) you get dividends and corporates have been handing out a lot of those (the reward? but of course reward also includes a lot of excessively high remuneration to the top executives whilst paying out the lowest salaries that they can get away with to their staff)

* just like me, pension funds have to invest somewhere and they can’t put it all in bonds because interest rates are so low

* then there’s all that QE that governments have been indulging in since 2008 (so I’d be a bit crazy not to take advantage of it, even though I don’t much like it)

* there’s a lot of oldies around who have now retired who have savings they need to put somewhere. Yes, boomers have been retiring these last few years. It’ll stop once they’ve all died off (err… yes I’m that age group too, but don’t think of myself as one as I have somewhat different values from most of them)

* the tax system also plays a big part but it’s one I struggle to keep on top of as it changes so rapidly

I’m sure there are a lot of other reasons which I don’t understand but really the stock markets haven’t reflect the state of companies for quite some time. It’s all a bit mad and so I still keep a fair bit in cash, earning me zero, but hey ho!

Ah, mad times I agree. But nothing unusual there. Studied economics for years, so loath to comment. Do not have the energy after a long day at work. Oh yes, brave soul am I braving a killer virus (?) and actually leaving my home.

“Ah, mad times I agree.” …How true

Another thing Fiels Law of Political Econ…BIG BUS=BIG Political Donations! Read access & corruption!

An important reason large companies can succeed at the expense of small business is the red tape. Also be interesting to see comparison between valuation and percentage of taxation collected by governments.

Totally agree, Stephen. Red tape is a real burden on any start up whilst it’s just yet another extra pair of hands in the compliance dept for, say, Facebook.

I recall some time ago Zuckerberg facing some politicians at a hearing almost begging for more regulation.

It’s not just the Red Tape it’s also complex & oft ambiguous Laws) & the Litigation costs & risks with all that for even the most innocuous things…..& Big Corps can afford to take those risks, get loophole advice..& many even have in house Lawyers & Personnel HR Staff…Who want to hire if you can’t fire…or you might have these huge “redundancy” costs…even the risks of even Insurance Companies paying out.. using all sorts of tricky “devices” & the disincentive of litigation costs/risks for a claimant….The legal system is also a disaster…Far too slow, to costly & too tricky…What a disincentive for sm enterprise?..Another problem for small business is to some degree “The cards are stacked” if you win for a spell the Govt & Banks win…if you lose only you lose …and then you are broke & have no seed capital…It’s a disaster…seems New Zealand was smart …they simply took the view Govt should assist & facilitate all enterprise (within reason)..& fast track ii & NOT inhibit it..

“* there’s nowhere else as interest rates have been so low since 2008” Yes!…Stock & Real Estate are the only investments that are inflation resilient….& there is “Official Inflation figures” & prices in Supermarket & Trades going up a genuine 8-14% pa I suspect

I would suggest a plausible explanation is that the rapid growth of the market coincided with the collapse of communism, which opened up huge market opportunities and gave access to resources once restricted by communist rule. The multinational corporations were ideally placed to step in and benefit. Either through sales or increase access to cheap labour.

The biggest companies make the majority of their money outside their host county, meaning that it’s not a bigger slice of the domestic pie they’re taking but a larger slice of the global pie. Since the growth of these companies had very little to do with their indigenous work forces, especially since much of the labour intensive work was off-shored in these years, benefits in the home countries were mostly felt through increased pension pots and increased government tax revenue.

This is not to say that there aren’t real issues with the growth of massive multinational corporations that rival the size of small governments. But the analysts that greedy corporations took all the money is painfully simplistic.

Another plausible explanation is that pensions used to be government backed, or expected to come out of cashflow of a company that would never go bust.

Since the 90s, pensions are invested in the stock market more.

And as a result the companies, in a diversified manner, now have equity on their books rather than the “pension debt” which used to be hidden from view.

How many times did you used to read “This airline looks healthy on the balance sheet, but it’s about to be hit by a mushrooming pensions bombshell”?

Newer companies don’t have the pensions obligations of older companies, so their valuation is higher, only that value is owned by pension companies…

One of the biggest drivers of stock market gains over the last couple of decades has been the rise of companies like AAPL, GOOG, NFLX, AMZN and FB. Yet the author writes: “The last thirty years has been marred by the stagnation of growth, wages and innovation.” The reason the indices have grown faster than GDP is that the winners are innovators and are listed companies (hence included in both GDP and the index) and the losers have been smaller “old economy” businesses who are included in GDP but not in the indices.

Can I have the time back I wasted reading this? #1) What percent of the private economy is publicly held today vs the past (hint: more) and #2) Where are interest rates (and therefore cap rates) relative to past? (Hint:The LOWEST they have ever been AND with a flat curve). Author should write on other subjects.

I don’t think you can get the time back – mind an attractive idea. Imagine a time when ….

surely the main reason is that the stock market has become a gambling enterprize and in some way a ponzi scheme based on percieved opportunities to make a quick buck-and then get out before the market correction/real fundamentals kick in. It seems to me that the global market must be 20/30 % overvalued due to the fact that this amount will disappear off it once quantitative easing ends and many companies fold/consumer spending stays low/unemployment is permanent etc etc

Pretty poor article, but yes stock market valuations are bizarre.

Economics education is the biggest gap in public knowledge about why we are in this mess, what is global debt and what is coming! Please get Jim Rickards or Tuomas Malinen of GnS Economics for example to post an article or interview. In a nutshell ““ off the gold standard 1970’s, fiat (unbacked by assets) currency comes back again, casino investment banking floods the stock market crash after crash, govt QE /money printing debt and global debt balloons, much QE goes straight to the stockmarket via global banks hence inflated stocks. Super cheap borrowing means companies borrow and are allowed to buy back their own stocks to inflate their own share prices and make money that way ““ not via actual profitable business operations (eg Amazon). Global debt and fiat money is out of control, interest at zero distorts with no savers, bank instability, then the corona crash and more QE to pump it back up and here we are. It is only a matter of months before systemically important global banks go bust and someone has to come up with a new monetary system

Last sentence seems simplistic. As another poster below has said, there have been significant developments over the last 30 years, rise of ecommerce, AI, robotisation/automation, gene sequencing, battery technology in vehicles, solar & wind power to name a few. The stagnation in wages is partly due to the huge transition from old labour heavy practices to new labour light(er) ones.

Nevertheless in absolute terms poverty has continued to fall over this time worldwide.

There are issues of inequality in the share of the economy different groups get, but I think that many Developed World Govt’s continued meddling without understanding the implications of their intervention in labour markets, business regulation has caused as many problems as it’s solved.

Governments are fantastically bad allocators of capital too. The Gov’t interventions during the Covid 19 panic will likely further prove this over coming years.

What a simplistic, inaccurate and lazy conclusion! It’s the greedy corporations, typical leftish twaddle.

My parent’s generation (I’m 70) are the first generation to die with money in the bank and assets like real estate. Wealth generation was no longer the purview of the so called 1% but a goal for a growing middle class. Combine the start of this wealth transfer with the growth of employment and two-income families the accumulation of assets was inevitable for many who saw their opportunity. The stock market was the perfect vehicle to drive this wealth generation. As my generation shuffles off this mortal coil that transfer of wealth will continue unless the left and/or the elites can figure out how to wrench it from our hands.

I suggest that the article is a reasonable analysis. Remember the crash of 1987, the dot com crash on the 90’s, the crash of 2008. There is no doubt that over the long term stock market investments tend to give real returns but there are many times when we see a crash. OK if you have other funds to draw on if you believe that the shares will recover and you can afford to wait. So far that has been the case and it is the oversubscribed all eggs in one basket who lose out. Not leftish twaddle but realistic questioning of whether the current situation will remain.

Historically yes …hold out BUT I suspect this is different …it might likely be more like depression & folks won’t have any real money & there will be little demand for corporates & others to “battle on”…Also how many flies are in big debt…ordinary folks too..We will see

Historically yes …hold out, BUT I suspect this is different …it might likely be more like a depression & folks won’t have any real money.. & there will be little demand for corporates & others to “battle on”…Also how many Corps & Folks are in big debt…even ordinary folks too….Folks might have Helicopter Money buy might be nothing on the shelves to buy?..It’s posits how stupid we are not having plenty of out own food production & 2ndry Industry .We will see?

Thoughtful. As you say, we will see.

Theory says that printing money on the scale we have seen in the last 20 years (and especially since 2008) ought to cause high general inflation, yet the RPI inflation has remained moderate (under 3%). What is going on?

The theory is for a hypothetical helicopter dropping cash uniformly. That is not what has happened. The new money has not gone to ordinary consumers. Mostly it has gone straight into the financial markets via bond purchases and cheap loans to the banks. From there, some has trickled down into the rest of the economy.

Those closest to the money spigot have taken their cut (and used it for themselves) before spending it down to the next level. After several levels, some gets down ordinary consumers in their pay packets. This is the Cantillon effect.

Where is the biggest inflation? It is in the stock market and in real estate. The graph is largely accounted for by the point injection (and thus uneven distribution) of the newly printed money.

I don’t pretend to know but my thoughts are:- Inflation also low because of cheap imports & real incomes (vis a vie demand from the “the other half”)..but for how long?? There are so many “known knowns, known unknowns & unknown unknowns” to quote one of the “Axis of liars” who conjured up the outrageously bad Invasion of Iraq (Funny how “he” didn’t know when we mostly did!!)…Other factors of unknown part:- Cheap Imports, enormous fiscal spending, Stock buy outs, Central Bank/s buying stock (US), the “Imputation of dividends (i.e. Tax Free Divs.), Capital Gains Tax rules in Stock & Real Estate et al &, possibly most importantly, Superannuation.. it goes on, also The Wars, MIC, Big Pharma ++……It’s called “Political Economy” & run no MSM lies, Wars & huge Money lending (bit only available & cheap for some!) …it’s a total disaster of Govt. regulation, entry barriers & compliance costs. & delays, Taxes. …”they” could not have created a more profligate unproductive, inefficent economy if they tried…Simply we are just NOT competitive & where will it lead to??..Importing debt & people & exporting wealth & jobs.. We need to “Blow up out TV’s” & start demanding better policies…THANK HEAVENS for the likes of various “debate feeds” & the likes UnHerd…long may the reign (“Unmoderated” i.e. Uncensored!). Free speech & debate is the answer along with the Internet

The graph is an indication of the increasing financialisation of the economy (the inflation of financial assets relative to the rest of the economy). It also means that GDP (which is a purely financial measure) is increasingly divorced from the real economy.

GDP never really measured the real economy, but as long as it correlated with it, it could be used as a proxy indicator of economic health.

Just to give you an indication of how inadequate GDP is, reflect that housework is not counted despite being an essential activity. Or what about the apparent GDP spike when rebuilding following a natural disaster (the prior destruction of capital is not counted). Or regulatory compliance which acts as an economic drag but generates lots of professional fees (which boosts GDP).

In other words, GDP can rise while the total economy declines. Finance is not the economy, merely the most easily measured part of it.

actual profitable business operations (eg Amazon). Global debt and fiat money

is out of control, interest at zero distorts with no savers, bank instability, then

the corona crash and more QE to pump it back up and here we are. It is only a

matter of months before systemically important global banks go bust and someone has to come up with a new monetary system

Having read the original article in VoxEU I was left with a raft of questions which I could not see an answer to. The most basic question is have they got their data correct. To take the UK only the FTSE100 is lower today than it was 20 years ago before we take inflation into account. If I look at an alternative data source I read

The current ratio of total market cap over GDP for UK is 92.56%. The recent 20 year high was 184.45%; the recent 20 low was 72.42%.

https://www.gurufocus.com/g….

As others have mentioned, the fact that interest rates have been declining for around 4 decades, which drives up the value of stocks as a relative investment, seems to be a likely factor. I also suspect that deregulation of stock markets in the 80s and 90s and the introduction of internet-based trading available to the masses, both of which drove trading costs down dramatically, are also an important factor. E-trade was founded in 1991 and trading vol. there exploded in the 90s.

So many things wrong here, not least that retail investors have been net sellers of stocks for fifteen years, contra the author’s assertion that they have been piling in.