In housing, similarly, we restrict supply by making it harder and harder to build new units, especially in city centres where demand is the highest. Meanwhile, we subsidise demand by providing government-guaranteed mortgages and by offering huge tax breaks for anyone who purchases real estate, especially investors.

And in K-12 education, school districts around the country are trying to stamp out charter schools, which increase supply, while at the same time arguing for higher and higher per-pupil spending. The cost to educate one child for one year has increased 173% (adjusted for inflation) since 1970, and half the kids still can’t read.

The pathologies of these sectors all follow similar patterns. Politicians proclaim their desire to “protect” quality and “help” consumers. Industry lobbyists step up to write bills that restrict supply and subsidise demand. Prices go up. Providers become more and more reliant on the government for their profits. Consumers become more and more reliant on the government to afford homes, healthcare, and schools. Instead of investing in innovation, providers spend their money on political donations and lobbyists. Politicians become dependent on those donations. Consumers demand more and more help because prices are going up, and they’re getting ripped off. And the beat goes on. “It really is a self-reinforcing process,” says Kling. “People don’t understand that the subsidies drive up prices, so they keep demanding more.”

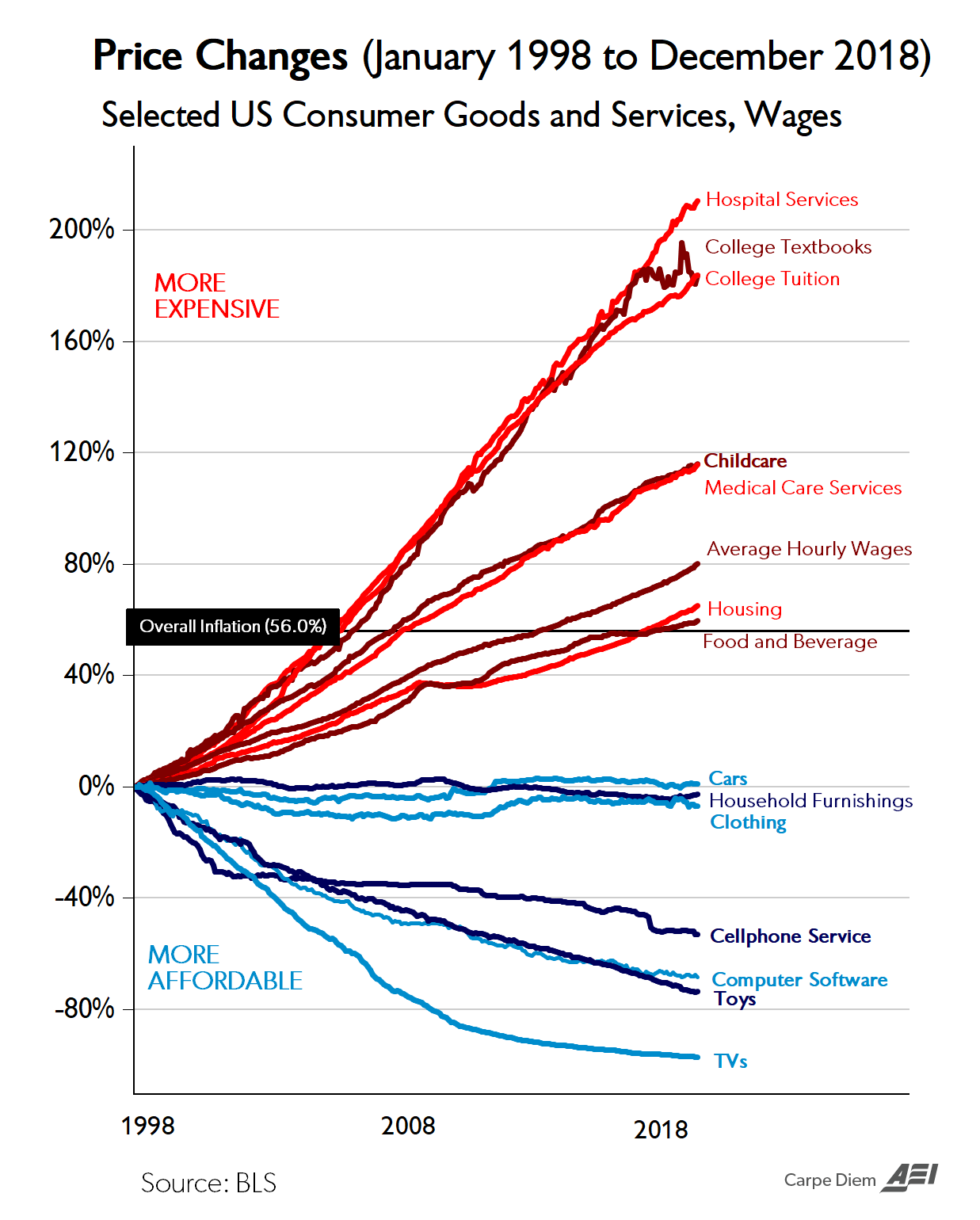

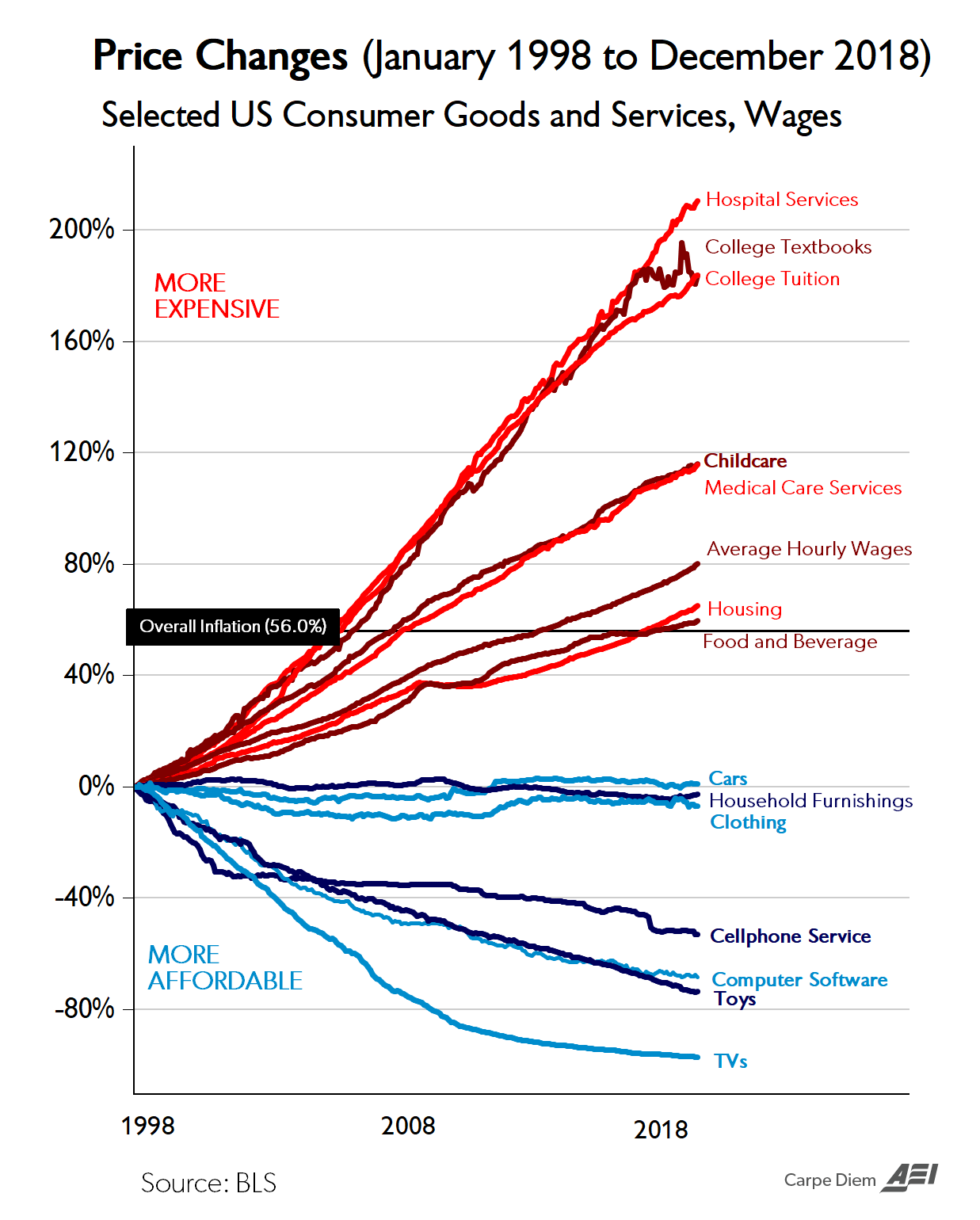

In a 2020 book, I called this phenomenon the Bleeding Heart & the Robber Baron, because it represents a political alliance between the compassionate and the greedy. It goes a long way toward explaining so much of what is wrong with American public policy and the economy. It also explains what Bloomberg has called the “chart of the century”. Below is economist Mark Perry’s infamous inflation chart, showing that certain sectors of the economy have seen dramatic inflation in recent decades, even while other sectors have seen prices decline.

The top seven components of CPI — all of them in the Bleeding Heart sectors of education, health, and housing — have seen inflation of 56-210% over the last 25 years. Meanwhile, almost all of the other sectors have seen prices remain flat or even decline by up to 90%.

Using Kling’s insights, the tech investor Marc Andreessen has labelled these Bleeding Heart sectors as the “slow” sectors. According to Andreessen, the reliance on government largesse leads to “slower productivity growth, slow adoption of new technologies… and then as a consequence of all of that, rising prices”.

Tragically, neither party wants to talk about this. Both Democrats and Republicans have participated in — and benefitted from — this new age of Robber Barons. Democrats fight new housing in the cities; they forgive student debt; they subsidise the consumption of health insurance and healthcare. Republicans, meanwhile, support big tax breaks for real=estate investors; they pass huge entitlement programmes that subsidise the purchase of subscription drugs; they back the privatisation of giant lending companies that enjoy de facto government guarantees and therefore dominate the mortgage market.

The biggest barrier to change will be those who benefit from the current policies, as many of us are addicted to one or more of these revenue streams. Providers, the modern-day Robber Barons, will resist any efforts to shut off the spigot of public subsidies. They will also fight any efforts to allow their competitors onto a level playing field. And understandably, the average American will be reluctant to give up his or her subsidies until the prices start to return to a normal level. “I wouldn’t describe the economy as addicted to it,” says Kling. “The economy would be fine if all of it went away. But I think the political system is addicted to it.” It’s not going to be easy, but the first step for any addict is admitting that you have a problem. And Arnold Kling is telling us the truth about our problem.

Main Edition

Main Edition US

US FR

FR

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

SubscribeAll of this sounds very familiar to me as a Canadian. Our Prime Minister even recently said the quiet part out loud, admitting that housing needs to retain its value, regardless of affordability concerns, because it represents a significant part of people’s retirement plans.

Due to catering to older people and investors (often one and the same), our big cities missed the mark on balancing density and livability.

This is why I think we need not just gentle density but gentle urbanity, built beyond existing metropolises, to provide people with the spaces they want. We’re going to have to look beyond city limits to fix our urban planning mistakes.

As a landlord, I can testify that this is true. I object to the term “greedy” however because my actions are merely rational. I am happy when a tenant is able to move out and buy a house. I want them to be stable and successful but I’m not their parent and I’ve yet to have a tenant volunteer to pay extra to help replace the roof, for instance.

I make agnostic decisions to get the highest return on my investments and noticed recently – quite by accident – that more and more of my leasing is to subsidized tenants and those delivering social services, e.g. group homes.

I am about to end the leases of several “normal” tenants because subsidized tenants are exempt from the municipality’s rent control regulations and will pay higher rents. Ironically, the long-term tenants probably voted for these regulations out of self-interest and now will have to move because of it. Rent control does nothing to “solve” housing affordability, it just reshuffles the incentives of each side in strange ways.

My biggest competition is housing owned by non-profits. They are much more experienced in directing the gusher of government spending in their favor and are exempt from property taxes (usually ~10% of gross revenue). In practice, they still respond to the same capitalist impulses to grow their “mission” because it supports staff compensation and executive bonuses.

On the other hand, I’ve never once heard of a non-profit housing agency selling or trading a building like for-profit investors do. Their portfolio just becomes a black hole, removing liquidity from the rental market and reserving units for subsidized and/or special purpose tenants.

Ivan Illich has a compelling theory that regulation passed for “safety” and such merely succeeds to ensconce middle-class tastes as the minimally acceptable standard of living. This seems true as every new “affordable housing” project has better amenities and quality than 75% of existing housing stock. It almost seems comically bimodal: live under a bridge until you get a spacious two-bedroom apartment with R-50 insulation and high-efficiency appliances.

I suspect the only possible solution is substantially more housing diversity. But this would require accepting forms of housing that don’t fit middle-class sensibilities. Crowded rooming houses, not-to-code buildings, temporary structures, etc. I don’t see that happening so it seems the government’s solution – as this article implies – will be to continue the economically inefficient model of using taxpayer money to sell a dollar for fifty cents.

You are kicking out your working tenents to make way for people on housing subsidies.?..charming..With capitalists like you we dont need socialists to destroy the remaining productivity of our society.. enjoy your subsidy farming, i wont say i wish you the “rational” result of your behaviour – but this kind of short term profiteering from government subsidies wont end well for anyone – i hope you have the balls to tell those hard working peasants yourself to go live somewhere else

He doesn’t makle the rules. He doesn’t even agree with them. But what can he do ? He has to operate with the rules he’s given.

The article is bang on – the prime fault is with governments and regulators for creating these rules. Just as with bank regulation. Or big tech. Or big pharma pricing.

Kicking out working , good, regular rent paying tenants to maximise profit by taking in government subsidies is disgusting and reprehensible. But he may well get tje tenants he deserves. All sorts of nice people living under bridges these days.

A “ bleeding heart” reply to economic reality.

Subsidies are the opposite of economic reality. They are economic distortion.

I suspect I do have the “balls,” considering I sign my comments instead of sniping from the shadows.

I would prefer to continue renting to the existing “tenents” [sic] but the regulation renders this unwise by fixing allowable increases below the rate of inflation by rule. I’m not familiar with any workable business plan that entails selling a product at a price designed to fall below its cost of production. Even if the unsubsidized tenant was perfectly willing to pay the same rent as the subsidy to retain the unit, it would be illegal for them to do so – an utterly absurd result.

As this article predicts, I am acting in the exact way intended by the regulation – making leasing decisions in favor of subsidized tenants because there is an incentive to do so. As I wrote, rent control just distorts incentives in strange and inefficient ways.

If it was rescinded and I wrote that I was ending the leases of my subsidized tenants to rent at market rates instead, you would clutch your pearls at that result too. This is because you have nothing at stake and reality will always be inferior to the ideal world you conjure from your callow imagination at zero cost.

If you’d like to rage against something, the appropriate target is the dimwitted activists who created the “most progressive rent control law in the country” and believe they are omniscient to know better than the two parties negotiating a private contract. It is they who biased this particular regulation in favor of the lumpenproletariat and against the ordinary tenant.

Hi Chris, just deleting this rather angry commemnt here via the efit button and offering an apology for my tone here. Ill let my original comment stand as it does reflect my view and makes a valid point. I dont really have anything else to add and no desire to offend you or get into an argy bargy here. Look it is your business and I wish you well with it whatever you choose to do. But we cant all go round blaming the government for all our problems. We need to do the right thing by people also. If you’ve good tenants , would you not take a small financial hit to do the right thing. The world will never be perfect and basic decency depends on people being decent

Understood and thank you for the polite revision. This why I only post comments on UnHerd where there is a higher concentration of English gentility.

I am frequently embarrassed to tell people I “do real estate” exactly because it is an industry so full of fakes, frauds, and bozos. I take it quite seriously that there are hundreds of people who depend, in some part, on my sound judgment. In making those judgments, I would suggest the landscape is considerably more complex and ethically fraught than you are allowing.

I once inherited a tenant from a purchase who got deep into dealing drugs from the apartment. We moved to evict but were stymied by the courts who were sandbagging eviction proceedings during COVID to “protect tenants.” Meanwhile, the neighboring tenant was being threatened by him. But since he hadn’t yet acted on the threats, the court would not grant an exigency and the process took six months instead of one. So, my personal judgment of what was best for the well-being of this actual flesh and blood tenant was of no effect versus these “tenant protections.”

I submit that my response to rent control is far better than the usual landlord of allowing the property to become a dilapidated and disorderly house. At the end of the day, no one can evade economic reality, no matter how sincere they are. If a company offers disproportionately generous pay and benefits, is that any comfort when a large account leaves and it goes bankrupt? If a landlord rents units far below market rates, is that any solace when heating costs spike and it goes to foreclosure because he can’t pay his mortgage?

Being a “good landlord” is a balance of acknowledging both human beings and economic realities. Shielding tenants from those unpleasant economic realities through some kind of misguided savior complex is what Ivan Illich would call “disabling help.” Just like the government’s increasing provision of social welfare, it denies people the dignity of agency and treats them like children. Absent a pulling back of such interference, I’ll simply continue responding rationally to changing incentives – even if not my ideological or political preference – and expect my tenants to do the same in their capacity as mature and free people.

Thanks for your interesting comments. I’m in the same boat as you, albeit under different circumstances. I was forced to sell property because of new rental caps that made it impossible for me to rent out. In effect the caps would make it so that I would be paying people to live in property that I am paying for. Not only that, but renter protection is so bad that any tenant can easily lay permanent claim to a property if they so choose to do so through rental tribunals. I now have perfectly good property lying empty in the Netherlands that I can’t rent out. They wouldn’t make me anything and the risk that I can never evict a tenant is enormous.

Well my sympathies are generally with working people at the moment, especially young people. Property owners such as yourself have been huge beneficeries of essy money policies and asset inflation. Now working people cant compete with subsidised protected categories which i guess include people with mental health problems, drug addiction, single parent household and refugees. I agree that all these things are thus incentivised and these things will become more and more common .If we all just follow rational inventives we would a young lad bother becoming a plumber. Better maybe to develop a drig addiction and live under a bridge until the council house comes through. Its an unconscious process but nonetheless powerful for that. We all , I believe, have a moral duty to ignore dodgy subdidies , just as I dont go falling in to potholes and sueing the council for easy money. If youre doing well then why not try and create a better world. You can still make a decent profit of “regular tenants. Im a big fan of ivan ilyich by the way..i love how he foresaw the medicalisation of society. I dont think he would take easy government subsidies either to be honest with you

I have a Rohrschach test for you:

When I get a call in the middle of a family dinner and leave to spend an hour or two in the basement fixing a boiler or a clogged sewer pipe, while my tenant is upstairs watching Netflix, which party is the “working person?”

Well i dont think fixing your own property counts as work from an economists point of view although i suspect an occupational therapist would disagree

Surely the most interesting point he’s making is that welfare-subsidised tenants are able to outbid normal tenants? That it’s an American equivalent of Britain’s problem a decade ago in which unemployment welfare gave a higher standard of living than minimum wage jobs?

How on earth can you expect a functioning rental market to deliver good homes at affordable rents when government itself drives rents up though subsidy in this manner?

One thing’s for sure: blaming a private landlord for failing to deliberately avoid maximising his returns is the wrong response to the situation.

I dont believe we can outsource business ethics to government. Anyone taking subsidies is in a dance with the devil to some extent in my view. Kicking out working tenents to take in subsidised renters is still indefinsible. Tbh i am amazed few others see this like i do judging by the votes and comments. Our business elites from top to bottom are corrupted by sibsidies just as the article outlines. Workers getting screwed. Wont end well

I don’t think anyone’s suggesting we can or should outsource business ethics to the government.

The point here is surely that in a functioning market, as per Adam Smith’s insight, business ethics are not necessary in the first place because it is the pursuit of self-interest that makes the market function as desired. In this scenario, it is government intervention that has broken the market. This is, in fact, a perfect demonstration of the central point of the article: government intervenes in a market, subsidises it, and creates an inflationary feedback loop between consumers, providers and subsidy-providers. You cannot keep people honest by appealing to ethical principles: you keep people honest by ensuring that their incentives are to remain honest, this is a general rule of life, and no different when dealing with people as economic units.

And on your final point, it’s less simple than you portray: a significant subset of the “workers” are part of the problem because they keep demanding more of the subsidies that are part of what screws other workers who may be less collectively organised.

Finally, although I agree with you that on the face of it, it’s indefensible for honest tenants to lose their homes just because the owner only cares about maximising returns, I have to point out that less than 15 years ago in virtually every part of the UK except prime central london, residential renting was a buyers market, with honest landlords desperate to find and hold on to good tenants who would look after the property and pay on time. What broke this model was government policy that spiked demand and restricted supply at the same time. The USA, which is where the OP clearly is from, has a somewhat different evolution to the UK, but the endgame, property-wise, looks the same.

Well i suppose now we are getting to the nub of it. In fiat world money crestion destroys this free market. If you have five houses now, easy to get the credit for a fifth, sixth, seventh due to money creation basically. But getting that first house is getting increasingly difficult.the government too can basicslly print money short term and distort the market. But really there is always two parties in this dance. And those getting fat off subsidies ( for housing, windmills or whatever) need to be held a bit morally responsible also.

The reason why some landlords can live off renting out only a few houses, or sometimes even one house today, is because of the reasons mentioned in the article. The value of housing is increased by keeping supply low and demand high. In many cases by rules, regulation and lobbying. This is all made even worse because of the monetary policy after the GFC of 2008. This pushed interest rates close to zero for years, which produced something of a Ponzi, producing even more incentive to keep supply low. Especially in big cities. So in essence, many people who do own homes – including many landlords – have subsidized mortgages.

A house in itself really does not have to be that expensive. For example, in Greece – not exactly known as an economic miracle – many people of all classes owned a home. And I mean own, no mortgage. Of course there will always be a market for tenants but in the West there are a lot of tenants that would rather buy but can’t. So instead they pay for someone else’s subsidized mortgage or rent from some financial behemoth that, one way or another, also profited massively from the central bank liquidity injections after the GFC.

Excellent, excellent essay. This is Unherd at its very best.

Yes, but he must have been living under a rock for the last 30 years. Why on earth does he think Trump, of all people, resonates with the deplorables? For this very reason! That’s why he must he must stopped at all cost to “save democracy”!

Did I read a different article ? Where is this about Trump ?

I just read Basic Economics by Thomas Sowell. Yes, I am painfully ignorant, but all of this is explained by Sowell in plain language. I’d recommend it. One of the few books I’ve read that made me feel marginally less stupid by the end. If only politicians would read it…….

Double recommend. It’s the best book I have ever read and it should be mandatory in all schools. You are not painfully ignorant; you are now one of the enlightened ones. You are sadly in a minority.

One of my close friends is a very successful hedge fund manager. He knows a thing or two about economics but is not a professional economist. He has also just read Sowell’s book and said the best thing was it crystallised everything he thought he knew but couldn’t quite explain to others. Only now he understands how everything fits together well enough to explain it to his children and challenge the professional economists he employs.

This article comes as no surprise to anyone who has read Sowell.

Yep, things are bad and getting worse as we move further from a free market.

But will a purely free market solve everything? In theory probably yes.

Nobody is suggesting a “purely” free market (whatever that even means anyway).

What is described is a broken market, a diagnosis of what’s wrong with it, and the implied assumption that the solution is the rollback of the government interference that has broken it. And it’s recognised that this is going to be very difficult because lots of powerful vested interests oppose it.

The argument is still worth having though, because the more people we can get to understand that it’s not the fault of free markets, the better.

It seems to me that these are the penalties for privatising public services – the state still has to provide but now at the cost of increasing profits to providers who have a stranglehold on the supply. A creeping poison in the UK despite it being exposed for the scam that it is (in water, energy, social care etc).

Since Gordon Brown broke the link between housing costs and interest rate policy the greatest beneficiaries of government fiscal and monetary policy have been metropolitan property owners. Everyone I know is a millionaire – but no-one got that way by working. When the millennials inherit we will be well on the way to the New Feudalism.

This is built into social democracy. As government becomes increasingly centralised and acquires more and greater spending power so it will attract growing numbers of parasites. Eventually all the resources are consumed by the parasites – boomer property owners in the UK for example, state pensioners in France etc – and the system disintegrates. This is where the West is now.

Why are they parasites? Surely they spent their working lives paying into the properties and pensions they own?

A boomer homeowner does not become a parasite just because decades of government incompetence has broken the housing market.

No, a boomer become a parasite when (s)he refuses to recognise that the unearned wealth should be taxed or that (s)he should, at the very least, pay for his or her own social care with it. A successful society is one in which people are rewarded for their contribution, not their vote.

Even if the Bleeding Heart & Robber Baron problem is fixed, I dont believe they economic challenges of 21st century will have been tackled altogether. Im not an economist but there are other underlying issues such as demographics of aging population, the scaricity of resources (e.g. minerals or energy), AI on the job market, the decline of marginal utility or our system which relies on never ending growth (GDP). It could be even that exactly aforementioned issues are one driver of the Bleeding Heart & Robber Baron phenomenon! People need to survive in our system and try to create and find opportunities and walk a path of least resistance.

The author presents some interesting modern examples based on the old practice of squeezing supply while trying to increase demand. In this case, with the help of the government.

So what is the solution? Recognizing that “government is the problem” and forcing them to take a step back? Perhaps. But that is exactly what they said in the Reagan/Thatcher 80s and that is precisely the period when all of this started.

Privatization and deregulation of public services led to cronyism. Perhaps because the neoliberal state was always way too intrusive. Surely that is not how someone like Hayek envisioned his free market. On the other hand, if we look at the postwar consensus (1950-1975) we see that governments were even more integrated into the market. This was because some public services were not privatized and had no profit motive back then. Also private capital accumulation was much more restricted by progressive fiscal policies. Both healthcare and higher education were much more affordable back then. Of course there are other factors, we have a lot of retired old people right now, for example. On the other hand, there are still countries in Europe where higher education is state owned, regulated but affordable. Arguably these institutions, on average, also offer better quality because they are less interested in selling degrees to whoever wants to pay and thus can afford to select students based on competence.

As for the subsidizing part, that seems to be an integral feature of the post-2008 neoliberal zombie state. Yes, a huge amount of deficit spending goes to public services who engage in cronyism, but what about practices like quantitative easing (QE)? This ‘trick’ put trillions of public (central bank) money into the pockets of big capital. This explains much of the housing market bubble and squeeze as well. Financial institutions got a lot free liquidity that all flowed to ‘assets’ like housing and stocks. At the same time QE pushed interest rates on credit to zero which incentivizes endless borrowing and speculation. So it’s not just public services that are “slow sectors”, our entire financialized market is engaged in rent seeking behavior much more than actual innovation and production. And it’s all enabled by endless stream of public money which, in the end, always seem to end up in the pockets of the barons.

“But that is exactly what they said in the Reagan/Thatcher 80s and that is precisely the period when all of this started.”

No it isn’t. Under Thatcher and Reagan, both the UK and USA rolled back the state. It rolled forward again in the 1990s with Clinton in the USA and New Labour in the UK.

I don’t say this to recommend a return to Thatcherism by the way: the vested interests learned from their thrashing by Thatcher and they are now remarkably adept at resisting any restoration of the economic accountability that market forces impose, as Liz Truss and Kwasi Kwarteng found to their cost (and in fact was discovered years before even by Gordon Brown when he tried to reintroduce a semblance of fiscal sanity after 2008).

You are right, though, that very often it is the desire to impose market discipline on state spending that leads to cronyism. Government officials are typically rather poor at negotiating with private sector interests, and once you add in the constant stream of regulatory overreach, we end up with the perennial problem whereby providing services to government becomes a specialisation in itself, which keeps out genuine competition, thus losing the main reason for involving the private sector in the first place – cost efficiency.

What a mess it all is.

“Under Thatcher and Reagan, both the UK and USA rolled back the state” – How did you come by this? Sure, privatisations shifted some power from state to private sector, but government spending went up 1.1% a year, in real terms under Thatcher, and up 70% under Reagan (not adjusted for inflation).

That graph is almost terrifying. The goods that have deflated or remained stable in price all have one thing in common: they are either imports or contain a substantial proportion of imported component in their manufacture. Prices of goods and services dependent on domestic delivery meanwhile have gone insane.

This shows the unbelievable folly of believing that it is actually a good idea to “reshore” production in an economy where subsidisation is rife. You think inflation is bad now, wait until you’ve reshored a few currently-cheap imports, and then you’ll see real inflation: vicious, spend-the-whole-paycheck-the-day-you’re-paid type of inflation.

Yet another argument for considering no longer voting in general elections. Maybe the solution is to allow the country to become “dilapidated and disorderly”, to quote Mr Hickey, and then gut the entire edifice and renovate it with new materials and ideas.

I’ve often suspected that it’s more rational for a US company to invest a dollar in lobbying than in R&D.

Great essay.

The “energy transition” to wind, solar, and electric vehicles and away from hydrocarbons, all to save the planet from an imagined climate crisis, fits the pattern perfectly.